Philhealth extends payment deadlines for employers

The Philippine Health Insurance Corporation (Philhealth) is extending its deadline for employers to remit their contributions for the applicable month of January until Febrary 2021.

The Philippine Health Insurance Corporation (Philhealth) is extending its deadline for employers to remit their contributions for the applicable month of January until Febrary 2021.

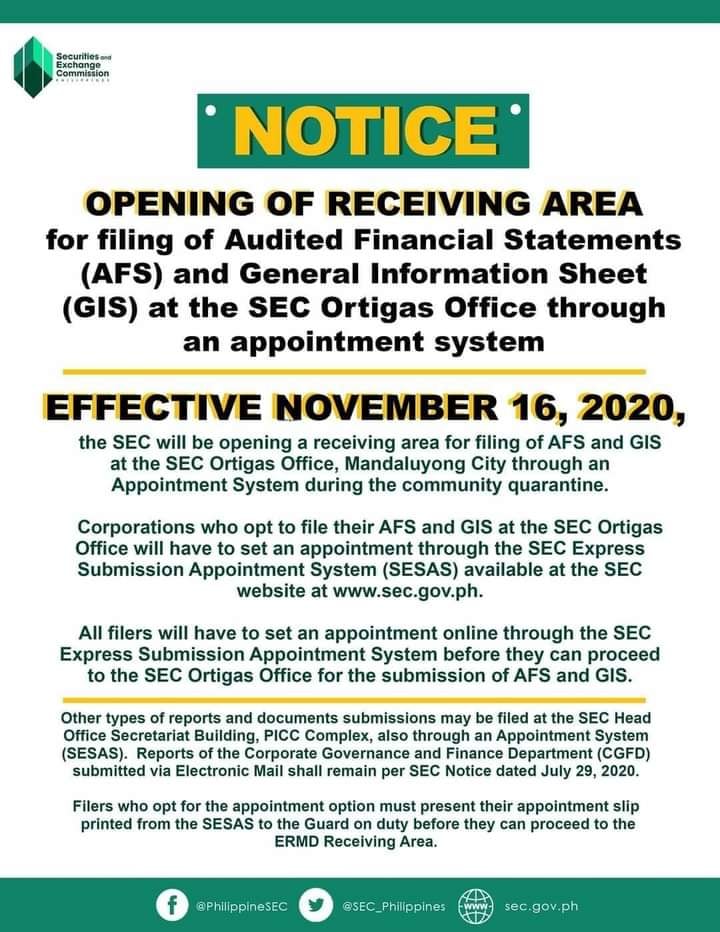

The SEC Ortigas Office has launched a receiving area for submitting Audited Financial Statements (AFS) and General Information Sheets (GIS) through an appointment system. This new setup is intended to simplify the filing process for businesses. Make sure to schedule…

This event will bring together industry leaders and professionals from Luzon to discuss important developments and share insights. Attendees can expect informative sessions and networking opportunities.

Implements the provisions of RA No. 11494 (Bayanihan to Recover as One Act) relative to the tax exemption of certain income payments.(Published in Philippine Star on October 17, 2020) For more details, see full text: RR No. 29-2020

Implements the tax exemption provisions under Section 4 (cc) and Section 18 of RA No. 11494 (Bayanihan to Recover as One Act) on the incentives for the manufacture or importation of certain equipment, supplies or goods. (Published in Philippine Star…

Suspends the filing and 90-day processing of Value-Added Tax (VAT) Refund claims anchored under Section 112 of the Tax Code of 1997, as amended, in relation to Section 4(tt) of RA No. 11494 (Bayanihan to Recover as One Act). (Published…

Implements Section 4 (zzz) of RA No. 11494 (Bayanihan to Recover as One Act) relative to donations of identified equipment for use in public schools.(Published in Malaya Business Insight on October 8, 2020) For more details, see full text: RR…

Revises the prescribed format of the Report on Specific Reasons for Increase (Decrease) in Collection Performance by Taxpayer, by Industry and by Tax Type (BIR Form No. 1771B) and Summary of Reasons for Drastic Changes in Collection and Impact on…

Modifies the Alphanumeric Tax Code (ATC) in BIR Form No. 2200-M (Excise Tax Return for Mineral Products) in connection with the implementation of RA No. 10963 (TRAIN Law) For more details, see full text: RMO No. 37-2020

Provides guidelines and procedures in the refund of erroneously paid VAT on imported drugs prescribed for Diabetes, High Cholesterol and Hypertension, as implemented under Revenue Regulations No. 18-2020. For more details, see full text: RMO No. 36-2020