Revenue Memorandum Order No. 35-2020

Prescribes the policies, guidelines and procedures in providing Regional Technical Support.

Prescribes the policies, guidelines and procedures in providing Regional Technical Support.

Creates the Alphanumeric Tax Code (ATC) for Voluntary Assessment and Payment Program pursuant to the implementation of Revenue Regulations No. 21-2020.(Voluntary Assessment and Payment Program for Taxable Year 2018 Under Certain Conditions) For more details, see full text: RMO No.…

Creates the Alphanumeric Tax Code (ATC) for Fuel Marking Fee pursuant to the implementation of RA No. 10963 (TRAIN Law).

Creates and modifies the Alphanumeric Tax Code (ATC) for Excise Tax in BIR Form No. 2200-AN.(Excise Tax Return for Automobiles and Non-Essential Goods) pursuant to the implementation of RA No. 10963 (TRAIN Law)

Suspends the enlisting/delisting of Large Taxpayers.

Clarifies certain issues relative to the Voluntary Assessment and Payment Program (VAPP) pursuant to Revenue Regulations No. 21-2020.

Clarifies the proper modes of service of an electronic Letter of Authority.

Publishes the full text of Government Quality Management Committee Memorandum Circular No. 2020-1 entitled “Guidelines on the Validation of the ISO 9001: 2015 Quality Management System (QMS) Certification/Recertification as a Requirement under the Support to Operations (STO) Target for the…

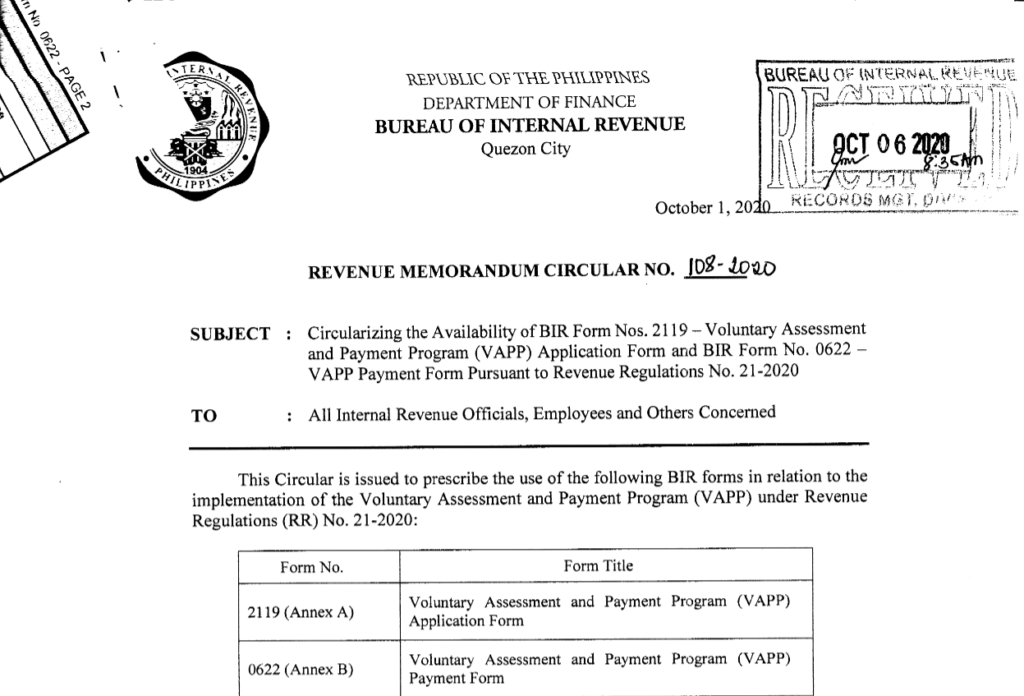

Prescribes the use of BIR Form Nos. 2119 – Voluntary Assessment and Payment Program (VAPP) Application Form and BIR Form No. 0622 – VAPP Payment Form pursuant to Revenue Regulations No. 21-2020.